Welcome to Sellpay , your trusted destination for seamless bill

payment solutions. Whether you

need to settle your credit card bills or manage utility payments

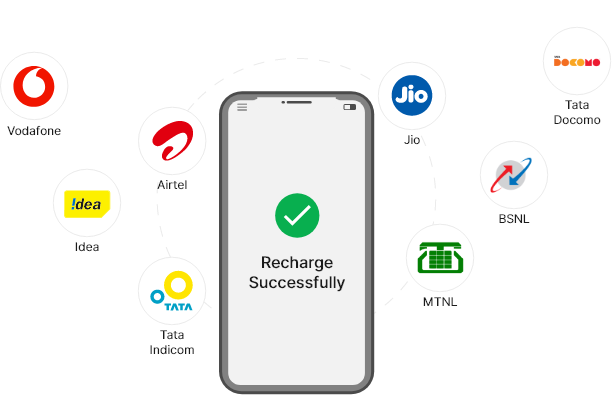

We offer recharge for all Operators like Airtel, Aircel, BSNL, Idea. Vodafone, MTS, Reliance CDMA, Reliance GSM, Tata Indicom, Tata Docomo, etc.

Pay multiple bills instantly on a single platform. You can pay the electricity bill, mobile postpaid, telephone bill, water and many other postpaid services.

Scan & pay service offered by SellPay enables users to make payments swiftly by simply scanning QR codes. This convenient method allows for seamless transactions at stores, restaurants

The UPI Payment recharge service is a convenient and efficient way for users to top up their mobile prepaid accounts, DTH (Direct-To-Home) services, and other utility bills using the Unified Payments Interface (UPI) platform.

Electricity Recharge refers to the process of topping up or adding credit to an electricity meter or account to maintain uninterrupted access to electricity supply.

Fastag Recharge Service offers a convenient solution for replenishing funds on your Fastag account swiftly and securely. Fastag, an electronic toll collection system in India, enables automatic deduction of toll charges as vehicles pass through toll plazas

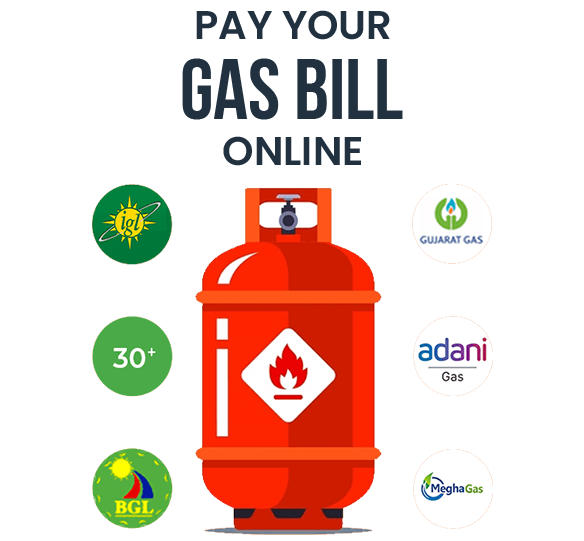

The gas bill service is a utility offering provided by gas companies to their customers. It involves the calculation, issuance, and management of bills for the consumption of natural gas. Typically, customers receive a monthly bill detailing their gas usage, along with any applicable charges and fees

The water bill service is an essential utility provided by water supply companies to consumers. It encompasses the calculation, issuance, and management of bills for the usage of water. Typically, customers receive a monthly or quarterly bill outlining their water consumption, alongside any associated charges and fees

Insurance is a financial product that offers protection against specific risks in exchange for regular premium payments. It works on the principle of risk pooling, where individuals or businesses pay premiums to an insurance company, which then uses these funds to compensate policyholders for covered losses or damages.